During a recent conference call with President Donald Trump, some governors expressed concern about state revenue shortfalls caused by effects of the coronavirus.

Telecom and utility providers are critical to the country’s infrastructure, but many co-ops and municipalities are faced with making short-term decisions focused on cash management.

A recent article published by Deloitte identified 15 ways to manage cash flow during a period of crisis. Deloitte is a multinational accounting organization that has the world’s largest professional services network, ranked by revenue and number of professionals. One of Deloitte’s recommendations is to actively engage with financing partners and to explore new or additional financing options.

To help fleet operations managers better understand the options for maintaining as much financial liquidity as possible without compromising investment in mission-critical equipment, the Terex Financial Services team recently answered some frequently asked questions.

Q: Historically, we are a cash buyer of utility equipment. I have been charged with maximizing cash flow in order to build up cash reserves for emergency use. What financing options will let me do that while maintaining my fleet purchase plans?

A: “If you have concerns, it is important to be proactive to establish the financing options available to you,” said Al Herndon, financial services business partner for Terex Financial Services. “Terex Financial Services can offer lease and finance options that include deferred and skipped payments to keep your fleet replacement cycle on track,” he said.

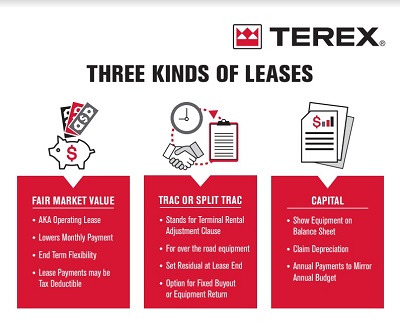

Terex Financial Services offers three kinds of leases.

Fair Market Value Leases, also known as operating leases, can lower monthly payments and give you end of term flexibility, allowing you to update or replace equipment more often. In addition, lease payments may be tax deductible, and we encourage you to consult with your tax adviser where applicable. Generally, this option has the lowest monthly cost.

TRAC or Split TRAC lease refers to a terminal rental adjustment clause and is used for over-the-road equipment. This lease has a set residual at lease end, which gives you the option to have a fixed buyout while still having the option to return at lease end.

Capital Leases allow the lessee to show the equipment on their balance sheet and claim depreciation. This is a common lease for municipalities that look to pay for capital equipment over time. Lease can be set up with annual payments to mirror the annual budget.

Q: Is leasing a more cost-effective way to acquire fleet than cash purchase?

A: “It is important that the fleet manager consider the true cost of using and maintaining a piece of equipment over its life. The longer you keep equipment, the greater the maintenance costs. Sometimes, it is actually less expensive to lease equipment,” said Herndon.

Another benefit is that a new warranty is issued each time equipment is replaced, potentially saving out-of-pocket expenses for downtime and repairs. Leases also eliminate costs associated with disposal and transfer of equipment at the end of its life.

Q: I currently have equipment on order. What are the repercussions if I decide to delay purchase or delivery?

A: During times of crisis, when cash flow is a concern, investment in capital equipment is often postponed. However, it is important to balance that with capital investments that are necessary for supporting essential infrastructure, and to consider what equipment will be needed on the rebound.

“The electric utility industry is considered a critical infrastructure industry. The need to maintain your fleet does not change, nor does the need to have a reliable fleet. Co-ops and municipalities should be cautious of adjusting their buying cycle. Delays now could mean long lead times later,” said Jamie Gibson, global director, Terex Financial Services.

If cash flow is a concern in the near term, Terex Financial Services can help find a solution that conserves a customer’s capital.

Additional questions can be directed to Al Herndon at al.herndon@terex.com.